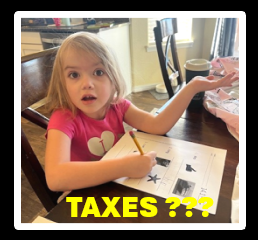

My daughter recently discussed a store purchase my granddaughter wanted and how much money she would need. Kala told Channing she would need a little bit more than the sale price because there was the additional cost of taxes.

The younger granddaughter, Madi, interrupted the discussion with her own observation. “Taxes?? I thought we were done with those at Boston! Americans do not want taxes!”

Never underestimate a first grader’s learning of American history. I believe she could someday be elected President of this country if she ran on the “No Taxes” platform.

First, a brief crash course on the Boston Tea Party which became one of the tipping, or should I say taxing, points to the American Revolution for independence.

The American colonists were still under the rule and governance of the British Empire. The colonists complained about how they were being treated as well as the taxation imposed on imported goods necessary for their survival. They were taxed but had no vote or say in how they were governed.

The colonists were taxed on everything including printed paper goods such as newspapers, legal documents, and most distressingly, playing cards.

One of the last taxations surviving the colonial complaints was a tax on tea. Only one tea company was allowed to supply America and its use was heavily taxed by the British government. New York City and Philadelphia refused to accept the company’s cargo. Boston remained the only delivery point.

A “we’ve had it up to here and ain’t gonna take it no more” group of men banded together and called themselves the Sons of Liberty. This included early American leaders Paul Revere, John Hancock, and John Adams. Samuel Adams organized the protest which is remembered as The Boston Tea Party.

On a December night in 1773, over one hundred protesters, dressed as Native Americans, boarded three English cargo ships, opened over 340 storage containers of tea (worth millions of dollars in today’s economy), and dumped it all into the Boston harbor.

“The lady doth protest too much, methinks.” (Shakespeare, Hamlet)

The British government closed Boston Harbor until the cost and the taxes of the tea were paid. They also punished all the colonists with new restrictive laws.

This became the last straw as representatives from all the thirteen colonies met in Philadelphia in what is referred to as the first Continental Congress. The seeds of the American Revolution were set in motion and the payment of taxes to England ceased. However, the subject of taxation did not end there.

Taxes? What is your feeling about taxes?

Benjamin Franklin is quoted as saying, “In this world, nothing is certain except death and taxes.”

I do not like either of those certainties and annually put off both for as long as possible. There is never a convenient time for either of them.

I cannot imagine anyone but a funeral director having anticipatory acceptance of “death.” Only the granddaughter of an IRS auditor might be happy with hearing the word “taxes.”

Will Rogers offered his thoughts on the subject. “The only difference in death and taxes is that death does not get worse every time Congress meets.”

Patrick Henry and other Founding Fathers of America considered taxation without representation a bad thing. They did not live long enough to see how bad things have become to have taxation with representation.

The people who complain about taxes can be divided into two types, men and women. (I will forego any comments regarding cultural correctness.)

Mark Twain raised the question, “What is the difference between a taxidermist and a tax-collector? The taxidermist takes only your skin.”

I have a few questions about taxes.

Why does it seem that a slight tax increase costs you hundreds of dollars, but a huge tax break saves you two dollars and fifty cents?

Why does tax reform mean that the government stops taxing something they previously taxed in order to tax something that has never been taxed before?

Why does the IRS know exactly how much I owe, but they demand I figure it out exactly or I will be punished with fines or possible imprisonment? Why don’t we have a law that requires the IRS to figure out how much taxes I owe, but if they are incorrect, I do not have to pay anything.

The brilliant Albert Einstein once remarked, “The hardest thing in the world is to understand the income tax.” I believe that is the only thing Einstein and I have in common. Now, even the minds of first-graders orbit in a higher stratosphere than my thoughts have ever gone.

The questions which baffle me are more simplistic.

Why does it feel as If you work harder, you pay more taxes to help the people who work half as hard? Or you pay increased taxes so the government can forgive the federal debts of others?

Even when the best things in life are free, how does the government find a way to tax them? Our savings and retirement accounts are taxed. My tax refund was my own money to begin with.

Is a tax shelter a place of refuge for homeless tax accountants?

If you worry about a tax audit, avoid the red flags when you file your taxes. But what are the red flags? If you have any money left to yourself, that is a red flag.

Someone needs to make “taxes” an investment option in the stock market. It has a surefire history of steady increases.

Here is a Wisdom thought.

Something else is a better investment of your life and its resources of time, talents, and things. And it is not taxable…yet.

Consider what it means to follow Jesus.

Jesus not only paid his taxes, but he called tax collector Matthew to be one of His trusted disciples (Matthew 9:9). Jesus also loved and befriended the culturally hated tax collector named Zacchaeus (Luke 19:1-10). (The second century church leader, Clement of Alexandria, wrote that Zacchaeus became one of Peter’s traveling companions.) Jesus also shared social space with the tax collectors’ friends who were from that same despised group (Mathew 9:10; Luke 15:1).

There was a deep-seated hatred for tax collectors in the earthly days of Jesus. Some of that sentiment is shared in our society. Tax collectors were considered unlikeable (collecting unwanted taxes), traitors (working for the oppressive Roman government), and notoriously corrupt sinners unworthy of forgiveness or fellowship (dishonest cheaters who enriched themselves by stealing from both the Jewish people and the Roman government).

Tax collectors were enemies of the people, an unwelcome and unnecessary evil. They were commonly known to be lovers of self and lovers of money, not lovers of God.

Why did Jesus love tax collectors? The religious stuff shirts and their country’s sons of liberty wanted to know (Matthew 9:11). Why?

Jesus taught and practiced love for one’s enemies. He said that if one only loves his friends, he is no different than a tax collector who only helps people when the benefit is reciprocated. “Love your enemies…If you only love those who love you, what reward is in that? (Do you expect a gold medal?) Even the tax collectors do that” (Matthew 5:43-46).

The #1 Textbook emphatically describes something more certain and more lasting than both death and taxes. It is God’s transformative love.

Jesus offers a transformative love with the power to change enemies, tax collectors, spiritual stuff shirts, misguided sons of liberty, and us. Jesus always includes the least, the last, and the left-out. His love embraces the marginalized and the ostracized.

The love of Jesus forgives past wrongs and gives future hope. And we never owe taxes on God’s forgiveness or hope.

Jesus clearly states that the evidence that we understand God’s love for us, and its enabling transformative power is that we love all others, not just our tribe. We love our enemies, not just the people who will reciprocate benevolence.

We forgive wrongs. We give hope. Instead of getting and keeping as much as we can, we give as much as we can. (Taxes might be the only exception to that goal.)

How can we love others, even our enemies? The desire and power to love comes from Jesus, not us.

Jesus Lives in us to Lead us to others He intends to Love through us.

You and I can love unlikeable people, even tax collectors. That greatly enlarges the circumference of our love’s circle.

So, somewhere in this strange world of taxation, love can survive.

God’s love has no limits in time or amount. It is both infinite and immeasurable.

Let me close this tax tribute with some final thoughts.

I encourage you to invest and reinvest your earthly life into something which will outlast it. Remember the most important thing. Love God and love others. Love first and love most.

That does not get taxed; it pays ever-increasing dividends. It never sees death. It only uses death as a departure port for your life and love to set sail into an endless forever.

“I forgot” has never been an acceptable excuse…for love or taxes.

So, my tax advice is limited to this. Find a good accountant who has an IRS loophole named after him.

And teach your kids about history and taxes.

How? I like actor Bill Murray’s suggestion.

“The best way to teach your kids about taxes is to eat 30% of their ice cream cone.”

And the answer is “No” to my granddaughter’s suggestion that Little Bo Peep could get a tax deduction for losing her sheep. But I like her thinking!

She is already wondering if Cinderella must report the transformation of her pumpkin into a golden coach as long-term capital gain.

Honestly, I never thought of that. Maybe they teach that in second grade.